The sudden need for emergency cash, a medical bill, an urgent repair, or a problem you just didn’t see coming can make any financial option look good, especially one promising fast money with no credit check. That’s where the car title loan comes in

In short, a car title loan is the kind of loan that uses your car as collateral. The process is fast and easy, but it comes with a big risk: your vehicle could be repossessed if you fail to pay the loan on time.

Key Takeaways

- A title loan is the type of loan you can choose for emergency cash

- The title loan uses your vehicle as collateral. Failing to pay the loan on time will result in your vehicle being repossessed by the lender

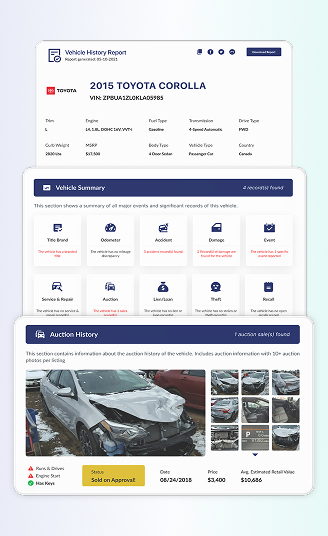

- Always run a VIN Decoder to get the vehicle history report, to ensure the vehicle has a clean title

How Does a Title Loan Work?

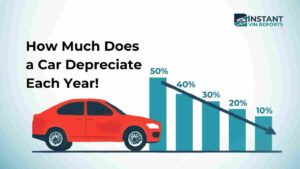

For those unfamiliar with the product, a title loan allows you to borrow a sum of money, typically 25% to 50% of your vehicle’s current market value, by using your clear vehicle title as collateral. You keep driving the car, but the lender places a lien on the title.

The loan term is a short-term solution. You will need to repay the loan, usually in 15 to 30 days. A title loan is different from a traditional loan; the interest is usually higher than a bank, and if you cannot pay the loan on time, your vehicle might be sold by the lender.

Why is a title loan not a good choice? Because a title loan is almost the same as a payday loan, it can be categorized as a predatory loan. This type of loan has unclear terms and conditions and targets people with bad credit scores.

What Secures a Title Loan?

To understand a title loan, you must first understand the fundamental concept of collateral. With a conventional mortgage, the house is the collateral; with a standard auto loan, the financed car is the security.

In the case of a title loan, you must own your vehicle. If you plan to apply for a title loan, the vehicle’s title must be clean. Then, after you get the money, the lender will hold your title.

Here’s what you generally need to know about the process:

- Own the Vehicle Outright: You must possess a clear, lien-free title in your name. Lenders will verify this, often running a quick history check, much like the VIN checks we’ve performed for decades.

- Collateral is Non-Negotiable: The value of your car, not your credit score, determines the amount you can borrow. Lenders use third-party sources like KBB to determine the vehicle’s resale value.

- Lender Holds the Title: Upon receipt of the loan funds, the lender becomes the temporary lienholder. They hold the physical title document until the debt is fully satisfied.

- The Repayment Clock is Short: Most title loans operate on a very tight 15- to 30-day repayment window. That’s a short period for a significant financial obligation.

Read also: What Is a Branded Title Vehicle?

How to Apply for a Title Loan?

To apply for a title loan, you will need to meet these requirements:

- Clear title vehicle under your name

- Identification, like ID cards or passports

- Proof of income to prove that you can pay back the loan

- Proof of residency

- Vehicle Inspection

- Duplicate keys because some lenders wanted to have the keys

Steps to Apply for a Title Loan

Once you’ve met all the requirements to apply for a title loan, here are the steps you need to take when applying.

Gather the Documents

Collect all the documents you need to have, like the ID card, proof of residency, proof of income, etc. Refer to the document above to check the required documents.

Apply Online or Onsite

You can apply online or visit the lender’s office to fill out the application.

Vehicle Checking

After you’ve filled out the application, the lender will inspect the vehicle to ensure it meets the requirements. The lender will then calculate the value to determine how much loan you can get.

Review the Loan Process

Based on the vehicle value evaluation and your proof of income, the lender will calculate and give you a loan offering. Ensure you check the details thoroughly, so you don’t miss anything.

Sign the Agreement and Receive the Money

If you accept the terms and conditions, sign the offering letter, and the lender will send you the money. The lender will keep the vehicle as collateral until you’ve paid the loan.

Title Loan Legality by States

Many states have outright banned them or capped interest rates so strictly that they are economically unviable for lenders. Currently, car title loans are legally permitted to operate in these 27 states:

- Alabama

- Arizona

- California

- Delaware

- Florida

- Georgia

- Idaho

- Illinois

- Kansas

- Kentucky

- Louisiana

- Minnesota

- Mississippi

- Missouri

- Montana

- Nevada

- New Hampshire

- New Mexico

- Oregon

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Virginia

- Wisconsin

Understanding the Exorbitant Cost

The most critical factor to absorb before considering a title loan is the cost. Because these loans are short-term and cater to borrowers with limited traditional credit options, the interest rates are almost always extraordinarily high.

Consider the reality of these rates:

Monthly Interest is Steep

A typical monthly interest rate on a title loan might be around 25%. If you were to borrow $2,000, your interest for that single 30-day period would be $500.

The APR Illusion

The stated monthly rate is what feels manageable, but the APR is the mechanism that demonstrates the true yearly cost if the debt is not paid off. It’s an astronomical figure designed to cover the lender’s high risk.

Fees Compound the Problem

Beyond interest, lenders can tack on various administrative, processing, and document fees, further bloating the final repayment amount.

You’ll hear the pitch that this loan is only for a few weeks, making the cost seem lower, but that calculation only holds if you can pay it off completely on the due date. Frankly, that’s where the trap lies for most borrowers.

The Danger of the Rollover Cycle

The 15- or 30-day repayment period comes quickly. If you cannot repay the full principal plus the interest and fees by the deadline, the lender will usually offer a “rollover” or “refinance.” This allows you to pay off just the fees and interest due, and then the lender extends the loan for another 30-day term with new fees and new interest.

This is the cycle that ruins personal finances:

Principal Remains Unchanged

When you roll over, you only service the interest charges. The original loan amount, the principal, is not reduced.

Fees Recur Monthly

You incur a fresh set of fees and another month of high interest for the new term. The cost to borrow the original amount doubles, then triples.

A Ticking Clock of Debt

Many borrowers end up paying the interest payment repeatedly, covering the monthly cost but never touching the principal. We’ve seen reports where the borrower paid more in interest than they initially borrowed.

Inability to Escape

The debt trap is set when the borrower becomes financially obligated to the monthly fee simply to prevent repossession, putting them in a worse financial position than when they started.

Ever notice how a financial crisis can lead to decisions that create an even bigger crisis? This pattern is the very definition of that consequence, often stemming from an inability to meet the initial short repayment window.

The Repossession Threat

The gravest risk inherent in an auto title loan is the potential loss of your primary means of transportation. Since the car title acts as security, defaulting on the loan, which includes a failure to pay the full amount or a failure to make the interest payment on a rollover, gives the lender the legal right to repossess the vehicle.

- Swift Action by the Lender: In many states, the lender does not need a court order to repossess your car once you default. They can act quickly.

- Loss of Transportation: Losing your vehicle can mean losing your job, your ability to manage family obligations, and your independence. This cascades the financial problem.

- Deficiency Balance Possibility: You might assume repossession clears the debt, but that’s not always true. If the car is sold at auction for less than the balance you owe, you can still be liable for the remaining debt, plus repossession and auction fees.

Losing your car and still being pursued for the remaining debt is the worst-case scenario. It’s what keeps us up at night thinking about this industry.

Alternatives to a Title Loan

Before you surrender your vehicle’s title to secure fast cash, we recommend that you take a step back and check if there is an alternative to a title loan. The high-interest nature and extreme risk of repossession associated with title loans make them a last resort or, as we see it, a route best avoided entirely.

Here are a few places to check before you sign any title loan agreement:

- Credit Union or Bank Personal Loans: These traditional institutions offer loans with dramatically lower APRs, even for individuals with imperfect credit.

- Credit Card Cash Advances: While not ideal, the interest rate on a credit card cash advance will almost certainly be lower than the triple-digit APR of a title loan.

- Negotiate with Creditors: If you are seeking funds to cover an outstanding bill, contact your creditors immediately. Many offer hardship plans, payment extensions, or temporary forbearance.

- Payday Alternative Loans (PALs): Offered by federal credit unions, these smaller loans have consumer protections, lower interest rate caps, and longer repayment terms than title loans.

- Borrow from Friends or Family: While perhaps uncomfortable, a no-interest or low-interest loan from a personal connection carries zero risk of losing your vehicle.

Next up, verify the rules in your state. Truth is, regulations vary widely, and what’s permissible in Texas might be strictly controlled elsewhere.

Title Loan Regulation

Many states have outright banned them or implemented strict interest rate caps, while others allow them to operate with few meaningful limitations. This patchwork of laws means you must research the rules of the state where you live and transact business.

Make sure you run these checks:

- Verify State Legality: Does your state explicitly permit title loans, or are they effectively banned through strict rate caps?

- Check the APR Limit: Is there a maximum interest rate? If the rate seems excessive, it likely is. Here in Austin, for example, title loans are regulated under a different set of laws, like the Credit Services Organisation Act, which complicates how the cost is presented.

- Review Repossession Rules: Understand the protocol for default and repossession in your state. Are lenders required to give you a “Right to Cure” period before the vehicle is sold?

- Know the Deficiency Balance Law: Does your state prohibit lenders from suing you for the remaining debt after the sale of a repossessed vehicle?

What's the Difference Between a “Title Loan” and a Normal Car Loan?

Feature | Title Loan | Normal Car Loan (Purchase/Finance) |

Primary Purpose | To secure fast cash for any immediate purpose (e.g., bills, emergencies). | To finance the purchase or lease of a new or used vehicle. |

Collateral Use | The vehicle’s title is used as collateral for the cash loan. You must own the car free and clear (clear title). | The financed vehicle itself serves as collateral for the loan used to buy it. You do not own the car outright yet. |

Typical Loan Term | Very short-term, typically 15 to 30 days. | Long-term, commonly ranging from 36 to 72 months. |

Interest Rates (APR) | Extremely High, often triple-digit APRs, sometimes reaching 250%–300% or more. | Significantly Lower; rates are fixed and competitive, typically in the single to low double digits. |

Credit Check | No credit check is required, as the collateral is the sole basis for the loan. | Credit Check Required, as credit history heavily influences the interest rate and approval. |

Repayment Structure | Often, a single, large balloon payment is due at the end of the short term (plus high fees). | Predictable, fixed monthly payments that reduce the principal over the term. |

Default Risk to Borrower | Maximum Risk. Failure to repay within the short window can lead to immediate and rapid repossession of the vehicle. | Lower Risk (over the short term). Defaulting still risks repossession, but the longer repayment term offers more time to pay and resolve issues. |

Debt Cycle Risk | Very High. If unable to pay, the loan often rolls over into a new term with new fees, escalating the debt trap. | Low. The fixed term and scheduled payments are designed to fully retire the principal and interest by the end of the term. |

Should You Apply for a Title Loan?

A car title loan offers immediate cash, often bypassing the typical credit-check process. Still, it does so at a big cost: the immediate risk of losing your vehicle. For anyone facing a financial emergency, we strongly recommend exploring every conventional financing option first, from credit unions to negotiating a payment plan with your creditor.

Only when all other safe routes are exhausted should you even look at a title loan, and even then, do so with your eyes wide open to the actual 250%+ APR and the very real chance of losing the car that gets you to work every day. Before you purchase a used car, make sure to run a title check by VIN to ensure the car has a clean title and is not tied to any loan or lien, so you do not end up being responsible for the lien.

Frequently Asked Questions About Title Loan

Can I still drive my car after taking out a title loan?

Yes, you can continue to drive your vehicle. The lender only holds the physical title document as collateral, but you retain possession of the car itself.

Does a title loan affect my credit score?

Typically, the lender does not run a credit check to issue the loan, and they do not report your payments to the major credit bureaus. However, a default and subsequent repossession may negatively impact your credit profile.

How much can I borrow with a car title loan?

Lenders usually offer a loan amount that is between 25% and 50% of your vehicle’s current resale value. This value is determined by the lender using standard industry valuation tools.

What is a "clear title" in the context of a title loan?

A clear title means you own the vehicle outright, and there are absolutely no outstanding liens or loans against the car. This is a mandatory requirement to use the title as collateral. Make sure you check the VIN and get the report to ensure the vehicle has a clean title, not marked as salvaged or rebuilt, and even unresolved lien.

What is a "rollover" and why is it dangerous?

A rollover is when you pay the fees and interest on your title loan, but not the principal, and the lender extends the loan for another term. It’s dangerous because the high fees and interest compound, trapping the borrower in a cycle of debt.