Buying or selling a used car should never feel like a gamble, yet hidden liens can turn a “good deal” into an expensive mistake. A lien means a bank, finance company, or even a repair shop may still have a legal claim on the vehicle, and that can affect your ability to register it, insure it, or keep it if the previous owner stops paying.

This guide shows you how to check if a car has a lien for free using practical, real-world steps so you can protect your money and avoid unpleasant surprises at the DMV.

Key Takeaways:

- You can learn how to check if a car has a lien for free by combining three things: the title, your state DMV records, and a simple VIN search.

- A lien means a lender or other party still has a legal claim on the car, which can affect registration, financing, resale value, and even lead to repossession if the debt isn’t paid.

- Before you buy or sell, always match the VIN on the car, title, and paperwork, then run it through a trusted tool like the Instant VIN Reports VIN decoder to confirm the vehicle’s identity.

What a Car Lien Is and Why It Matters

When you see a used car that looks clean, is priced right, and drives well, it’s easy to focus only on the paint and the mileage. But behind the metal, there’s a legal story written on the title. A lien is a crucial part of that story.

It tells you whether someone else, usually a bank, credit union, finance company, or in some cases, a repair shop or tax authority, still has a legal claim to the vehicle until a debt is fully paid off. In most states, that claim is recorded on the car’s title and in the state’s vehicle records.

If you skip this step and never learn how to check if a car has a lien, you’re not just missing “extra info.” You’re taking the risk that the lender, not you, is the one with real control over the car. That can affect your ability to register it, keep it, or sell it later.

How Car Liens Work in Simple Terms

Think of a lien as a safety net for the lender. When you finance a vehicle, the car itself becomes collateral for the loan. The lender’s name is recorded as lienholder on the title, and that status usually stays there until the loan is paid in full and a lien release is processed.

Here’s the basic pattern most people go through:

- You buy a car using financing.

- The title shows you as the owner, but it also lists the lender as the lienholder.

- You make monthly payments. If you stop paying, the lender can legally repossess the vehicle because their lien gives them that right.

- Once the loan is paid off, the lender issues a lien release, and the DMV updates the records so the lienholder is removed from the title.

In many states, the lien is clearly printed on the physical title or held electronically in the DMV’s system, so anyone looking at the official record can see that the car still has an attached debt.

Key Title Terms You Should Know

These are the core vocabulary terms you should know when investigating a title record:

Lienholder / Secured Party:

This is the creditor (e.g., the bank, a financial institution, or sometimes a private party) who holds the legal claim to the vehicle. Until the debt is paid, they are the “secured party,” meaning their interest is legally protected.

Recorded Date:

This is the specific calendar date the lienholder officially filed their security interest with the state’s titling agency, establishing the debt on the vehicle’s public record.

Released / Satisfied / Discharged:

These terms are all good news. They indicate that the debt has been fully paid off, and the lien has been legally cleared from the vehicle’s title record. Once you see one of these terms associated with the lienholder, the claim is gone.

Title Brands:

Terms like Salvage, Rebuilt, Flood, Junk, or Lemon are classifications applied to the title based on the vehicle’s condition or history. While not directly financial, they often appear in a comprehensive vehicle history report alongside lien data, helping you gauge the overall risk and background of the asset.

How to Check If a Car Has a Lien: What Really Works

Checking for a lien starts with understanding where lien information actually comes from. Some sources reflect the car’s legal status in real time, while others are meant only to flag potential issues before you dig deeper.

The most reliable lien checks come from title records, VIN-based verification, and state motor vehicle databases. Free steps can help with early screening, but they should support (not replace) the checks that determine whether a lien legally exists.

Free Ways to Screen for Possible Liens

There are several practical steps you can take that don’t cost anything except a bit of time and attention. These are your first line of defense before you even consider paying for anything.

Use Free VIN Tools for Basic Verification

A growing number of services let you enter a VIN and see a basic snapshot of the vehicle at no cost. These free tools often give you:

- Basic vehicle specs (e.g., year, make, model, engine)

- Recorded mileage at sales/auctions

- The available data preview of the deeper history that can be unlocked in a paid report

You can start with a free VIN lookup or basic check with our VIN decoder to ensure the VIN is valid and matches the car in front of you. It’s a simple way to sanity-check the vehicle details before you dig deeper or spend money.

At this stage, your goal is not to get every detail. Your goal is to see whether anything looks obviously wrong, like the car has a mismatched model and inconsistencies with what the seller claims.

Talk to the Seller and Ask for Proof

When you buy a used vehicle, you can also ask the seller direct questions. For example:

- Did you finance this vehicle?

- Is there an outstanding loan on it right now?

- Do you have the original title and any lien release or payoff letter?

A genuine, organized seller should be able to show at least one of the following:

- A title that shows no lienholder in the lien section

- A lien release from the lender, if the loan was paid off

- Current registration and loan paperwork that matches their name

You don’t pay anything for this step, but it already filters out many risky situations. If a seller gets nervous, refuses to show paperwork, or keeps delaying, you’ve just learned a lot without spending a cent.

Keep in mind that this step can take time, and sellers may forget about old loans or misunderstand their lien status. That’s why these checks are useful for screening, not final confirmation.

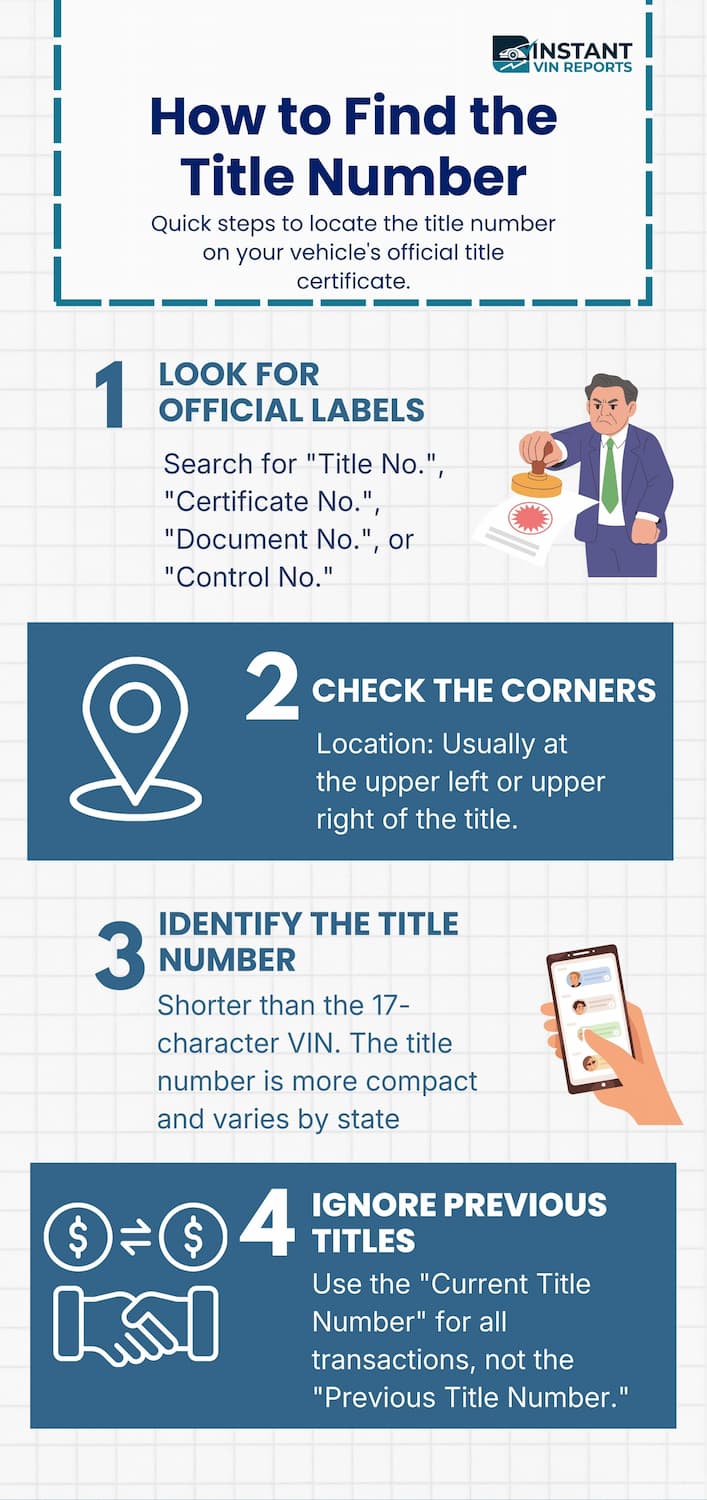

Look Closely at the Title

If it’s your own car and you’re wondering how to check if my car has a lien, pull out the title and registration you already have. Many owners are surprised to see that the lender is still listed there even though they “thought” everything was taken care of.

In many states, the title itself will tell you if a lien exists. Look for a section labelled something like:

- Lienholder

- Secured party

- Legal owner

If a bank, credit union, finance company, or other party is listed there, that’s a sign that there is or was a lien recorded. If it says “None,” or the section is blank, the title may be clear, but you still confirm through other steps later.

This visual check is free, quick, and gives you a first snapshot of the car’s legal status.

Get a Full Lien Check

Once you have performed the free checks and the vehicle looks promising, you should prepare to make a small investment to get the definitive answers. This small cost shields you from potentially inheriting thousands of dollars in debt.

Full Vehicle History Reports:

Free tools and DMV lookups each have their strengths, but they can still leave gaps. This is where a paid vehicle history report comes into play. It pulls together data from multiple sources to give a wider view of the car’s past.

You can use online tools like Instant VIN Reports. Here is what you can get, side by side with other providers:

Feature |

Carfax |

InstantVINReport |

AutoCheck |

|---|---|---|---|

| Price per Report |

$49.99

Expensive

|

$19.99

Affordable

|

$29.99

Fair

|

| Auction Record Photos | No | Yes | No |

| Vehicle Market Value | Yes | Yes | Yes |

| Full Vehicle Specifications | Partial Data | Complete Details | Partial Data |

| Original Window Sticker | No | Yes | No |

| Classic & Vintage Vehicle Support | No | Yes | No |

| Maintenance & Service Insights | Yes | Yes | Yes |

| Ownership Record History | Yes | Yes | Yes |

| Accident Records | Yes | Yes | Yes |

| Title Brand Check | Yes | Yes | Yes |

| Salvage Title Report | Yes | Yes | Yes |

| Ownership Timeline Map | No | Yes | No |

| Recall Notices | Yes | Yes | Yes |

| Heavy-duty truck and trailer VIN support | No | Yes | No |

| ATV and Motorcycle VIN support | No | Yes | No |

Combining a detailed VIN report with DMV records and your own paperwork checks gives you a much stronger picture than any single free step alone. The cost is usually modest compared to what you stand to lose if you buy a car with hidden problems.

State DMV/BMV Title Searches:

Most state Departments of Motor Vehicles charge a minor fee (up to $25) to run an official title and lien search using the VIN. This data comes directly from the state’s authoritative registry and provides the most current, official record of any active lienholders.

How Do Liens Affect Vehicle Ownership?

A car lien doesn’t prevent you from driving the vehicle, but it shifts control to the lender or lienholder until the debt is fully paid and released. This affects how you register, insure, sell the car, or use it as collateral in the future.

Who Really Controls the Car When There’s a Lien

Ownership can look straightforward, but a lien changes how control really works. You may drive the car every day, but that doesn’t mean you fully own it yet.

Title vs Possession: What the Lienholder Controls

The name on the title tells part of the story; the lienholder line tells the rest.

When a lender is listed as a lienholder, the vehicle is legally tied to that debt. You have possession, but the lender keeps a financial claim until the loan is paid and the lien is officially released. Until then, selling or transferring the car can be restricted.

In practice, that means:

- You can’t get a truly clear title in your name alone until the lien is removed.

- The lienholder’s claim will show up in official records when anyone checks the VIN or title.

- If you try to sell or trade the car, the lien has to be dealt with before a clean transfer can happen.

This is why so much of the process in used-car buying focuses on titles and VIN checks. You’re not just trying to see “who owns it”; you’re checking whether anyone else has a legal hook in the background.

Lienholder Rights if Payments Stop

When payments stop on a financed vehicle, the lienholder’s rights become very real.

Because the car is collateral, the lender can usually:

- Declare the loan in default after missed payments

- Repossess the vehicle, often without going to court first (depending on state law)

- Sell the car at auction to recover what’s owed

If you bought a car and never checked for a lien, you can end up in the middle of this process without warning. The lender doesn’t look at who handed cash to the seller; they look at the lien and the unpaid loan attached to the VIN. That’s why people who skip lien checks sometimes face the shock of a repossession even though they “did everything right” with the seller.

Why You Must Check for Liens Before You Buy or Sell

Failing to verify the lien status is a gamble with your finances. If you decide to skip this check, the consequences can be costly and immediate.

You Inherit the Debt

If the car is taken back or can’t be legally titled, you can end up paying twice: once to the seller, and again in legal costs or settlement negotiations. Even if you manage to keep the car, resolving the lien may require paying off a balance that should never have been your responsibility.

Risk of Repossession

If the debt behind a lien isn’t paid, the lienholder can repossess the vehicle. The lien stays attached until the debt is settled and properly released, and becomes a hidden lien.

Hidden liens are especially risky. If you buy a car without checking the title or running a VIN check, you might not know a lender still has a claim on the vehicle. If the loan is in default, the lienholder can repossess the car, regardless of what you paid the seller.

From the buyer’s point of view, a hidden lien can mean losing both the car and the money you paid, then being left to chase the seller after the damage is done. That’s why every serious guide on how to check if a car has a lien comes back to the same idea: never skip the checks that bring those hidden liens to light.

Title transfer trouble

In many states, you can’t get a new title fully in your name if a lienholder is still listed. The DMV’s system will show that someone else has a legal interest, and they may refuse to issue a clear title until the lien is released.

Because of these risks, consumer advisers and auto finance experts repeatedly warn people to verify lien status when buying a used car, not just rely on the seller’s word.

For sellers, ignoring an old lien is just as dangerous. If your loan was paid off years ago but the lien release was never properly recorded, you may run into problems when a buyer tries to register the car. The deal might stall, or fall apart, simply because the paperwork doesn’t match reality. That’s why it matters to know how to check if a car has a lien on it, even when you’re the current owner.

What to Do If You Find a Lien on a Car

Discovering an active lien on a car you’re planning to buy should not make you panic, but it must make you pivot. It means the transaction just became more complex, and you need to proceed with extreme caution and clear boundaries.

If You’re Buying the Car

You essentially have three courses of action when faced with an active lien, and two of them involve significant risk mitigation.

Require Seller Payoff:

This is the simplest and safest option for you. You require the seller to pay off the outstanding loan and provide you with an original, official lien release document before you hand over any purchase funds. You then finalize the sale with the officially clear title in hand. Waiting a few extra days for this paperwork is better than risking your entire investment.

Direct Payoff to the Lender:

If the outstanding loan balance is less than the purchase price, you can coordinate a direct payoff. You meet the seller at the lienholder’s bank, pay the lender the payoff amount directly, and then pay the remaining balance of the agreed-upon price to the seller. The lien is cleared immediately by the lender, and the paperwork can be initiated for transfer. This must be meticulously documented.

Walk Away:

If the seller is unable or unwilling to facilitate the payoff through one of the verified, transparent methods above, you must be prepared to walk away from the deal. There are simply too many risks associated with relying on verbal promises about financial commitments.

If You Already Bought the Car and Discover a Lien Later

If you purchased a vehicle and later a lender comes forward claiming a security interest, your immediate action is crucial.

Contact Seller and Lender:

Immediately gather all your purchase documentation and contact both the seller and the lender named in the lien. You must establish the facts of the remaining debt and use your bill of sale as proof of your purchase date.

Consult Legal Counsel:

If the lender threatens repossession or if the seller is unreachable and you suspect fraud, consult a local attorney specializing in consumer fraud or auto transactions. They can best advise you on your rights and the next legal steps.

Use Your Records as Proof:

Your documented checks (VHRs, DMV printouts, title copies) will demonstrate your good faith and due diligence, which is necessary if you end up in a legal dispute.

Conclusion on How to Check If Your Car Has a Lien

At first glance, how to check if a car has a lien sounds like a technical question. Once you understand the stakes, it becomes something much more personal. It’s about making sure the car you buy, drive, and rely on every day is truly yours, without hidden strings attached to a bank or a past owner.

By taking the time to:

- Match the VIN across the car, title, and records

- Read the title carefully

- Use state systems and, when needed, a full vehicle history report from a service like Instant VIN Reports

The time you invest in verifying the title’s status will protect your money, secure your legal ownership, and ultimately ensure you enjoy your new vehicle without the looming threat of inherited debt. Decode your VIN and confirm the lien status before you buy.

FAQs About How to Check If a Car Has a Lien for Free

How to find out if there is a lien on your vehicle?

To find out if there is a lien on your vehicle, check the vehicle title first. If a bank or lender is listed as a lienholder, the lien is active unless a release is recorded. For confirmation, verify the VIN with any lender you’ve used and compare everything with a recent VIN-based history report from a trusted provider such as Instant VIN Reports.

How to check if a lien is on a vehicle?

To check if a lien is on a vehicle, use a three-step check:

- Read the physical title and registration to see whether a lienholder is printed.

- Run a VIN search with your DMV or through the national title system they connect to, which will show the current title and any recorded liens.

- Cross-check with a vehicle history report to see when the lien was first reported and whether any release is noted.

How to make sure there is no lien on a car?

To be as certain as possible, you need both paperwork and official confirmation. The title should show no lienholder, you should have a lien release (if there was ever a loan), and the DMV’s current record for that VIN should list the owner only, with no active lien.

How to see if a car is paid off?

If the car was financed, it’s “paid off” when the loan balance is zero, and the lienholder has issued a lien release and removed their name from the title. Lenders are generally required to send a release or notify the DMV once the debt is satisfied. Ask the lender for a payoff letter or confirmation, then verify with the DMV that a clear title is now in your name alone.

How to check to see if a car title is clean?

A “clean” title usually means no major brands, such as salvage, rebuilt, or flood. You can check this by pulling the title record from your DMV and by running a VIN through a vehicle history report, which summarizes title brands reported by states and insurers.